retailers welcome opportunity to compete on level sales tax playing field

In big news out of Washington, D.C. this morning, the U.S. Supreme Court ruled in favor of a level sales tax playing field in South Dakota v. Wayfair. The case centered on a loophole in the law that allowed retailers without a physical presence in the state to avoid collecting and remitting state sales tax.

The Minnesota Retailers Association (MnRA) has long held the position that retail sales should be treated the same--whether in-store or online and regardless of the location of the retailer.

"It appears fairness is on a path to prevailing. Today's decision is a big moment for Minnesota retailers that have argued for sales tax fairness for years and years," said MnRA President Bruce Nustad in reaction to the news. "This is a great step in leveling the playing field and ensuring an online sale has the same tax treatment as an in-store sale."

"This issue has plagued retailers in towns across Minnesota as well across the country for years. Retailers welcome the opportunity to compete for customers on service, convenience and price, without a competitor having an unfair tax advantage," added Nustad.

In 2013 MnRA worked with the Minnesota Legislature and Governor to ensure retailers with a physical presence in Minnesota were collecting sales tax on their online sales, and in anticipation of today's decision the Association last year worked on remote-seller language to cover third-party marketplace transactions beginning July 1, 2019 or when a favorable decision was delivered (as it was today) by the U.S. Supreme Court.

With today's ruling, MnRA will take the next steps of analyzing the decision and continuing to work with our elected officials as well as the Minnesota Department of Revenue.

MnRA thanks the countless number of retailers that have worked on this issue over the years, as well as our legislative partners at the state and federal level.

Read the full decision here.

Written by Bruce Nustad

on Thursday, 21 June 2018.

Posted in Trends, Retail Operations, Policy & Politics

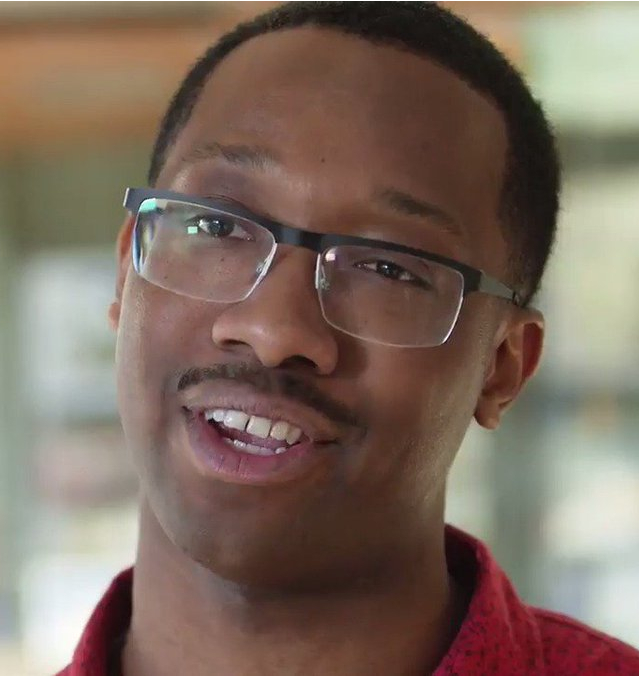

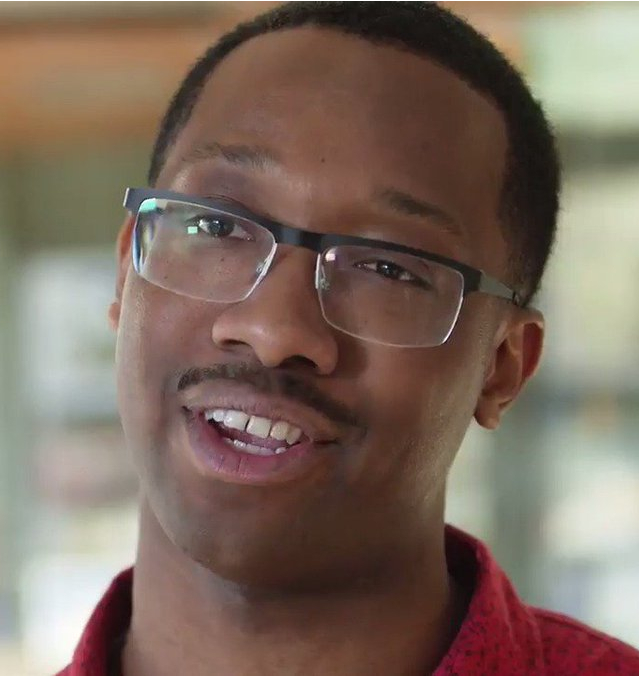

Retail Entrepreneur and 36 Lyn Refuel Station Owner Lonnie McQuirter Selected As 2018 Minnesota Retailers Association Board Chair

Lonnie McQuirter has been elected chair of the Minnesota Retailers Association (MnRA). In late January the Board of Directors gathered and selected McQuirter to lead the organization representing 1,200 retail stores. The volunteer leadership role is for one year and encompasses leading a group of 28 Board members from across the state and a staff focused on growing Minnesota’s retail economy and jobs.

McQuirter operates 36 Lyn Refuel Station, a convenience store based in south Minneapolis. 36 Lyn is focused on providing customers with local and better-for-you-items delivered in a convenience setting. Last year 36 Lyn was honored with Minneapolis/St. Paul Business Journal’s Fast50 award as and Inc. magazine's Inc. 5000 as a top Minnesota company.

McQuirter is optimistic about the overall retail environment, saying “Broadly speaking, as retailers we know what headwinds we’re facing, and we are adapting to the shifts taking place in the economy. 2018 is more about reminding people of the importance of our growing industry and all the opportunities involved.”

McQuirter succeeds Grand Jeté small business owner Ruthena Fink. “We are excited to have Lonnie and his love of community help guide the Association in a time when retailers are revitalizing their in-store and online experiences,” said MnRA staff president Bruce Nustad. “And we thank Ruthena for her inspired leadership throughout 2017.”

The Minnesota Retailers Association supports retailers to the benefit of their customers, their communities, their employees, and our state economy. Retail impacts one in five Minnesota jobs. Learn more at www.mnretail.org.

Written by Bruce Nustad

on Tuesday, 06 February 2018.

Posted in MnRA News

The Minnesota Retailers Association (MnRA) thanks economic development officials and Governor Mark Dayton for taking a measured and thoughtful approach when responding to Amazon’s second headquarters request for proposal.

“Today’s economic development environment is certainly competitive, and it is tempting to focus solely on attracting new jobs,” said Minnesota Retailers Association President Bruce Nustad. “For our state, there is a need for balance between improving the overall environment for existing businesses that invest in our communities and offering incentives to attract new businesses.”

As an organization representing a diverse retail industry, MnRA sees every day how important retailers and the jobs they provide are to each community around the State. Minnesota’s retail community includes over 50,000 retailers impacting more than 788,000 jobs.

Written by Bruce Nustad

on Tuesday, 14 November 2017.

Posted in Policy & Politics